WINNIPEG, MB – August 10, 2023 – Farmers Edge Inc. (“Farmers Edge” or the “Company”) (TSX: FDGE), a pure-play digital agriculture company, reports its results for the three and six months ended June 30, 2023. All amounts are expressed in Canadian dollars. Certain key performance indicators and non-GAAP and other financial measures used in this news release do not have a standardized meaning as presented by IFRS. See “Key Performance Indicators and Non-GAAP and Other Financial Measures” section below.

Business Highlights

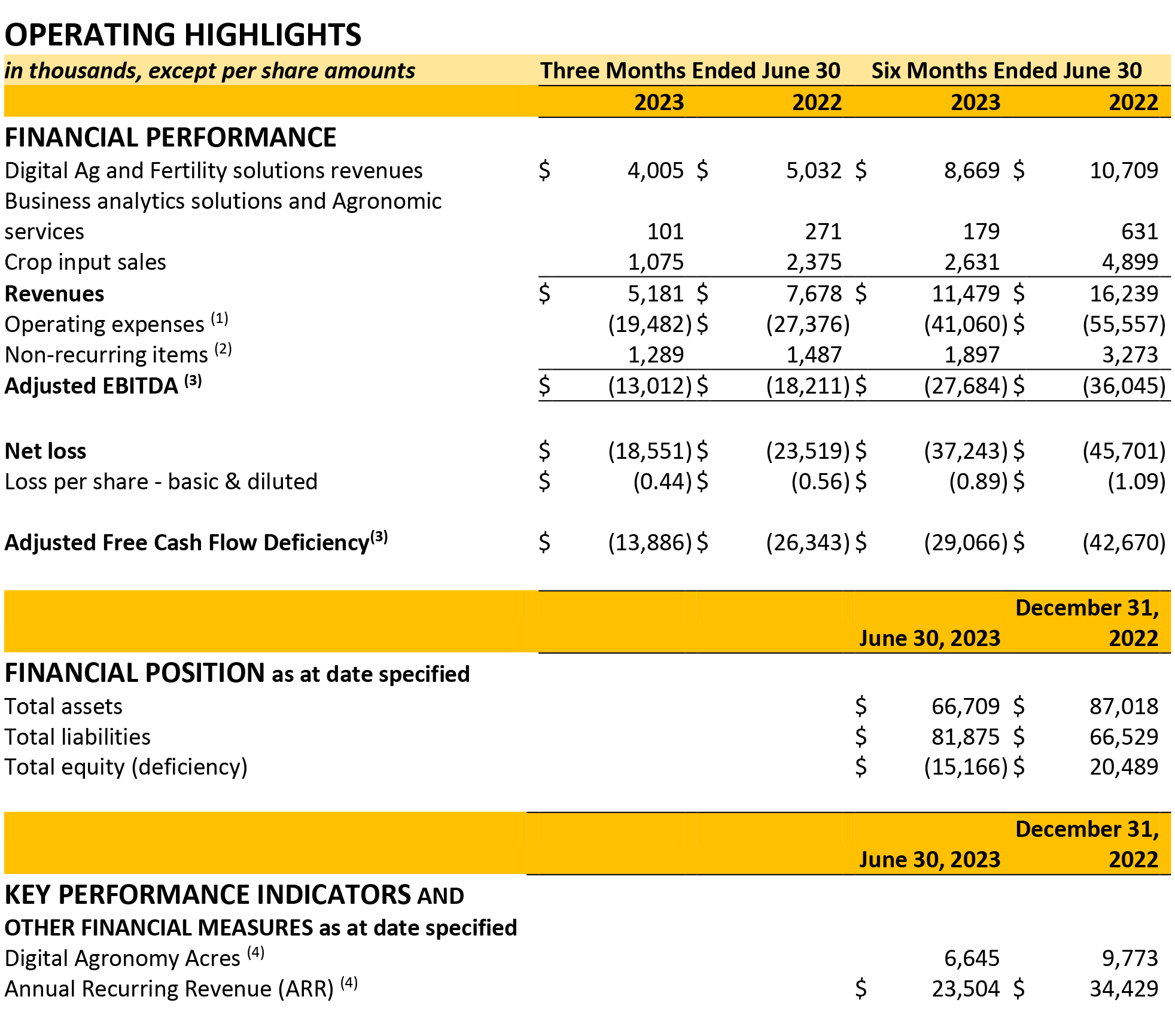

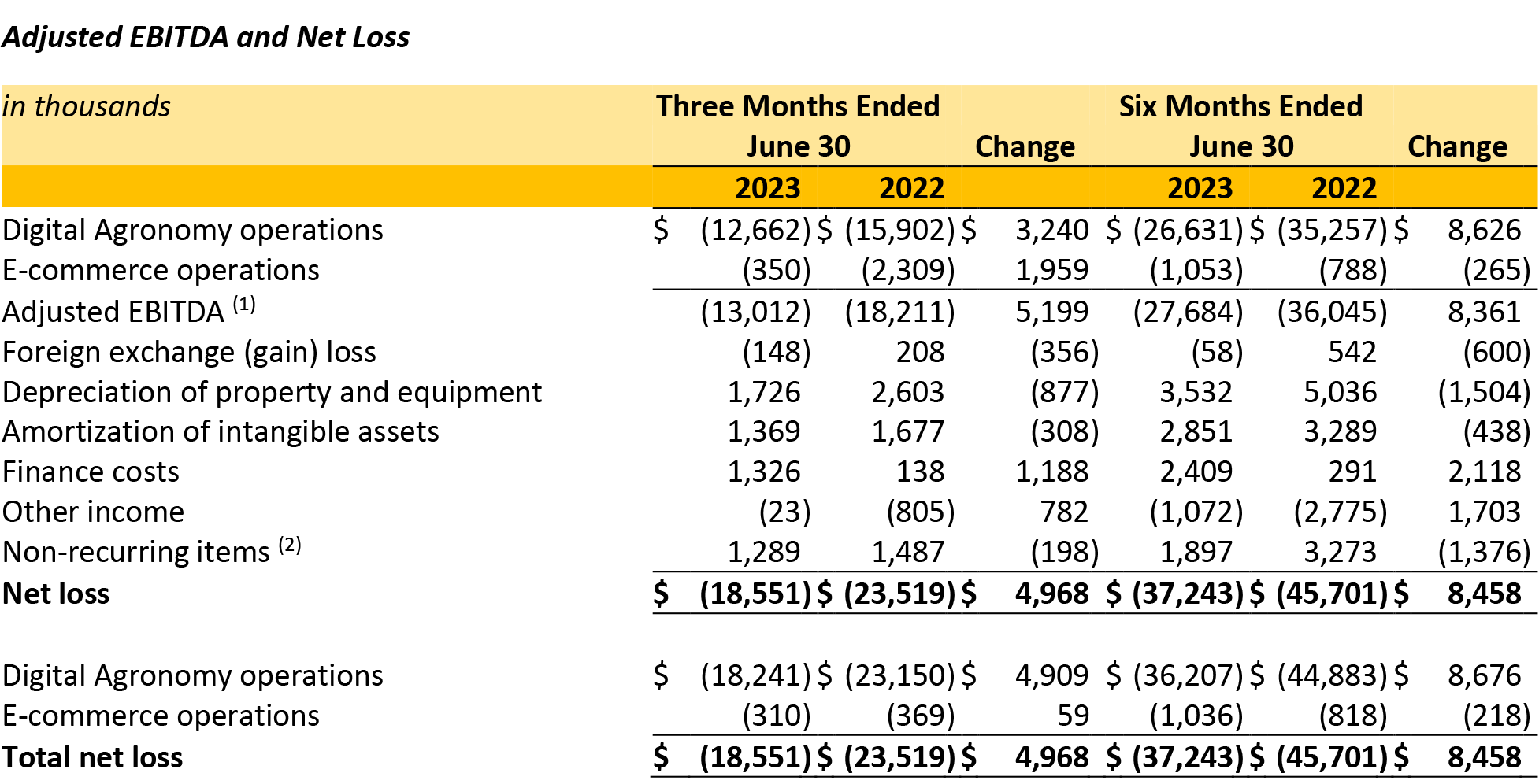

- The Q2 Adjusted EBITDA deficiency improved by 29% and 23% for the three and six month periods ended June 30, 2023 respectively over the comparable 2022 periods. The Free Cash Flow deficiency improved by 26% and 27% for the three and six month periods ended June 30, 2023 respectively over the comparable 2022 periods.

- The Company has delivered on its previously commenced plan in the fall of 2022 to achieve $20 million in annualized cost savings. As part of this effort, the workforce in North America has undergone realignment, including necessary head count reductions by 20% to support the implementation of the new business model. The Company in July 2023 also implemented a plan which consolidated operations and provides a self-delivery model which will drive annualized cash flow savings of another $20 million starting in the back half of 2023.

- Acre profitability remains a top priority and the average price per acre for subscribed acres at June 30, 2023 has risen to $3.50. During Q2 2023, 0.1 million new high value Digital Agronomy acres were added and 0.9 million acres, most of which are low valued, were discontinued. Our restructured sales team and new market strategy should help us add significant new acres over the remainder of the year as a solid foundation for growth has been set.

- ARR on June 30, 2023, was $23.5 million and is lower than December 31, 2022, primarily due to reduced Digital Agronomy acres which include cancellation of the Progressive Growing Program, discontinuation of low-value acres and lack of market for agriculture carbon offsets. Management expects digital agronomy revenue for 2023 to be similar to 2022 despite lower subscribed acres and carbon offset issues.

“Our optimization efforts have resulted in a significant improvement in Free Cash Flow and adjusted EBITDA in Q2, compared to the previous year,” said Vibhore Arora, Chief Executive Officer of Farmers Edge, said. “We maintain our unwavering focus on driving top-line growth by actively engaging with our valued growers and developing an enterprise customer network, while continuously developing bespoke, industry leading solutions that cater to their distinct needs.”

(2) Non-recurring items include restructuring expenses of $0.1 million and legal and consulting fees of $1.2 million in Q2 2023 compared to restructuring expenses of $0.4 million and $1.1 million in Q2 2022 related to legal and consulting fees. Non-recurring items also include restructuring expenses of $0.3 million and legal fees of $1.6 million in Q2 YTD 2023 compared to $1.2 million in restructuring costs and legal fees of $2.1 million in Q2 YTD 2022.

(3) Adjusted EBITDA and Adjusted Free Cash Flow Deficiency are non-GAAP financial measures used throughout this MD&A. See “Key Performance Indicators and Non-GAAP and Other Financial Measures” for more information on each non-GAAP financial measure. A quantitative reconciliation of Adjusted EBITDA to Net loss and Free Cash Flow, the most directly comparable IFRS financial measures are disclosed in our Interim Financial Statements to which Adjusted EBITDA, Free Cash Flow, and Adjusted Free Cash Flow Deficiency relates, is included in this press release.

(4) Digital Agronomy Acres and ARR are supplementary financial measures used throughout the MD&A and this press release. See “Key Performance Indicators and Non-GAAP and Other Financial Measures” for more information on each supplementary financial measure. These numbers are unaudited.

SECOND QUARTER BUSINESS UPDATE

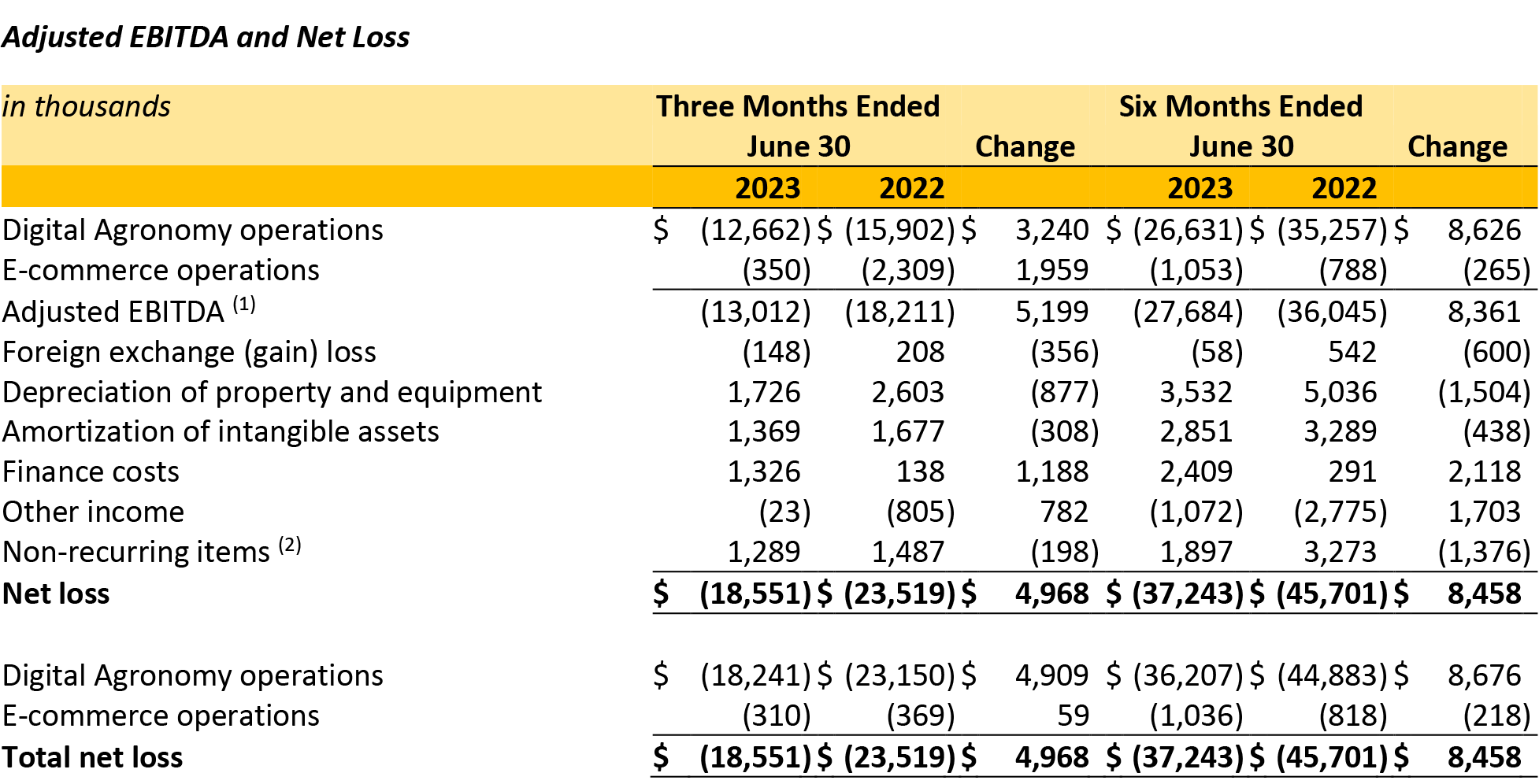

- The Adjusted EBITDA for the three and six months ended June 30, 2023, was a deficiency of $13.0 million and $27.7 million, respectively (Q2 2022 – $18.2 million deficiency and Q2 YTD – $36.0 million deficiency). The improvement in 2023 resulted primarily from efforts to reduce costs and optimize operations.

- The Adjusted Free Cash Flow Deficiency for the three and six months ended June 30, 2023, was $13.9 Million and $29.1 million, respectively (Q2 2022 – deficiency of $26.3 million and Q2 2022 YTD – deficiency of $42.7 million). This improvement reflects the Company’s commitment to operational excellence and improved efficiency in the reduction of operating expenses and improvement in cashflow compared to previous years partially offset by lower revenues.

- The Net loss for the three and six months ended June 30, 2023, was $18.6 million and $37.2 million, respectively (Q2 2022 – $23.5 million loss, Q2 2022 YTD – $45.7 million) which resulted in $4.9 million and $8.5 million improvement for the three and six months ended June 30, 2023 over the comparable 2022 periods.

- Digital Ag and Fertility solutions subscription revenue was $4.1 million for Q2 2023 (Q2 2022 – $5.3 million). This $1.2 million decrease resulted from lower subscribed acres related to discontinued low value acres in Brazil and discontinued acres in Australia as part of the closure of Australian operations. The decrease was mitigated by a higher average price per acre of 20% in Q2 2023 compared to the prior year.

- Crop input sales represent e-commerce revenue of $1.1 million for Q2 2023 (Q2 2022 – $2.4 million) and for Q2 YTD 2023 of $2.6 million (Q2 YTD 2022 – $4.9 million). The $2.3 million YTD decrease is due to a continued supply-demand mismatch caused by a weaker market and an oversupply of products and the transition of our ecommerce business to a commission-based model.

Conference Call Notice

Farmers Edge will hold a live audio webcast at 5:00 p.m. Eastern Time on Thursday, August 10, 2023, to discuss the Company’s financial results and business highlights. All interested parties are invited to listen to the live audio webcast at https://www.gowebcasting.com/12659. Following the event, a replay of the webcast will be available on the Farmers Edge Investor Relations website.

Key Performance Indicators & Non-GAAP and Other Financial Measures

This press release makes reference to certain non-GAAP and other financial measures and key performance indicators (“KPIs”). These measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management’s perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS. We make reference to the following non-GAAP measures: “Adjusted EBITDA”, “Free Cash Flow” and “Adjusted Free Cash Flow Deficiency”. This press release also makes reference to “Annual Recurring Revenue” or “ARR” and “Digital Agronomy Acres”, which are operating metrics used in our industry. These non-GAAP measures and KPIs are used to provide investors with supplemental measures of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS measures. We also believe that securities analysts, investors, and other interested parties frequently use non-GAAP measures in the evaluation of issuers. Our management also uses non-GAAP measures and KPIs in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation.

Adjusted EBITDA is the net loss before income tax expense, other income, finance costs, foreign exchange (gain) loss, depreciation and amortization after adjusting for the effects of any unusual non-recurring items. Adjusted EBITDA is a non-GAAP financial measure, and its more directly comparable financial measure that is disclosed in our interim Financial Statements is net loss. The Company’s management and Board use this measure to evaluate consolidated operating results. In addition, this measure is used to make operating decisions as it is an indicator of the performance of the business and how much cash is being used by the Company and assists in determining resource allocation decisions. This measure may not be comparable to similar measures presented by other companies. See reconciliation under “Results of Operations”.

Free Cash Flow is net loss, adjusted for other income excluding government subsidies and financial assistance, finance costs, foreign exchange (gain) loss, depreciation and amortization as set out in the Company’s consolidated statement of operations and comprehensive loss in the interim Financial Statements, stock-based compensation, net additions to property and equipment and intangible assets, repayment of right-of-use obligations, and any unusual non-recurring items. Free Cash Flow is a non-GAAP financial measure, and its more directly comparable financial measure that is disclosed in our interim Financial Statements is net loss during the period. The Company’s management and Board use this measure to assess the availability of the Company’s cash. See reconciliation in “Results of Operations”.

Adjusted Free Cash Flow Deficiency is net loss, adjusted for other income excluding government subsidies and financial assistance, finance costs, foreign exchange (gain) loss, depreciation and amortization as set out in the Company’s consolidated statement of operations and comprehensive loss in the Interim Financial Statements, stock-based compensation, net additions to property and equipment and intangible assets, repayment of right-of-use obligations, any unusual non-recurring items and changes in non-cash working capital. Adjusted Free Cash Flow Deficiency is a non-GAAP financial measure and its more directly comparable financial measure that is disclosed in our Interim Financial Statements is net loss during the period. The Company’s management and Board use this measure to assess the availability of the Company’s cash. See reconciliation in “Results of Operations”.

Adjusted Free Cash Flow Deficiency is useful as a performance measure to analyze the cash used in operations before the seasonal impact of changes in working capital items or other unusual items.

(2) Non-recurring items include restructuring expenses of $0.1 million and legal and consulting fees of $1.2 million in Q2 2023 compared to restructuring expenses of $0.4 million and $1.1 million in Q2 2022 related to legal and consulting fees. Non-recurring items also include restructuring expenses of $0.3 million and legal fees of $1.6 million in Q2 YTD 2023 compared to $1.2 million in restructuring costs and legal fees of $2.1 million in Q2 YTD 2022.

About Farmers Edge

Farmers Edge is an agriculture technology company with a broad portfolio of proprietary technological solutions, spanning hardware, software, and services. Powered by a unique combination of connected field sensors, artificial intelligence, big data analytics, and agronomic expertise, the Company’s digital platform turns data into actions and intelligent insights and delivers value to growers and all stakeholders in the agricultural ecosystem. Farmers Edge technologies accelerate digital transformation on the farm and beyond, protecting our global resources, supporting sustainable food production for a rapidly growing population and helping growers and businesses reach their growth and sustainability goals.

For more information on Farmers Edge, please visit www.farmersedge.ca. Additional information relating to the Company, including all public filings, is available on SEDAR (www.sedar.com)

Forward-Looking Information

This press release may contain forward-looking information within the meaning of applicable securities legislation. Such information includes, but is not limited to, statements related to the Company’s anticipated results and future cost savings and its future business prospects, partnerships, and opportunities, including the planned further expansion into the carbon credit market, and the anticipated benefits therefrom. Words such as “expect,”, “anticipate”, “intend,”, “may,”, “will”, “estimate” and variations of such words and similar expressions are intended to identify such forward-looking information. This information is based on the Company’s reasonable assumptions and beliefs in light of the information currently available to it and the statements are made as of the date of this press release. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company’s control, that could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking information. Such assumptions, risks and uncertainties include, but are not limited to, the factors discussed under “Forward-Looking Information” and “Risk Factors” in the Company’s most recent Annual Information Form and under the “Risk and Uncertainties” section in the Company’s management discussion and analysis filed today, August 10, 2023, each of which are available on the Company’s website (www.farmersedge.ca/investor-relations/) and on SEDAR (www.sedar.com). The Company cautions that the list of risk factors and uncertainties is not exhaustive and other factors could also adversely affect the Company’s results. Readers are urged to consider the risks, uncertainties and assumptions associated with these statements carefully in evaluating the forward-looking information and are cautioned not to place undue reliance on such information. The Company does not undertake any obligation to update such forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required by applicable law.

For further information:

Farmers Edge Investor Relations:

InvestorRelations@FarmersEdge.ca

(204) 992-7019

Farmers Edge Media Relations:

Media@FarmersEdge.ca