Technology Built for Crop Insurance

Enterprise-grade Crop InsurTech Solutions to streamline claims, underwriting, compliance, and risk monitoring. Purpose-built for agricultural AIPs and insurers – fully managed and easy to deploy.

Proven Impact Across the Policy Lifecycle

40% reduction

in claims processing time

50% reduction in manual data entry and admin workload

6–8 week head start on Seeded Acreage Reporting

2–3 month head start on Yield Production Claims

Backed by in-field data, 7,000+ weather stations and 95+% crop model accuracy.

Our Approach to Crop InsurTech:

Fully-Managed, Delivered as a Service

We consult, design, build, and manage data, white-labeled digital tools, and custom tech development tailored for agricultural insurance.

Deploy 3X faster with white-labeled mobile and web tools

Develop and scale custom tech for 30% less

Secure infrastructure for farm and policy data

Improve adoption with ongoing product optimization and technical support

Managed Technology Solutions

Mobile Adjusting

Forensic Claims

Risk Assessment

Custom Development

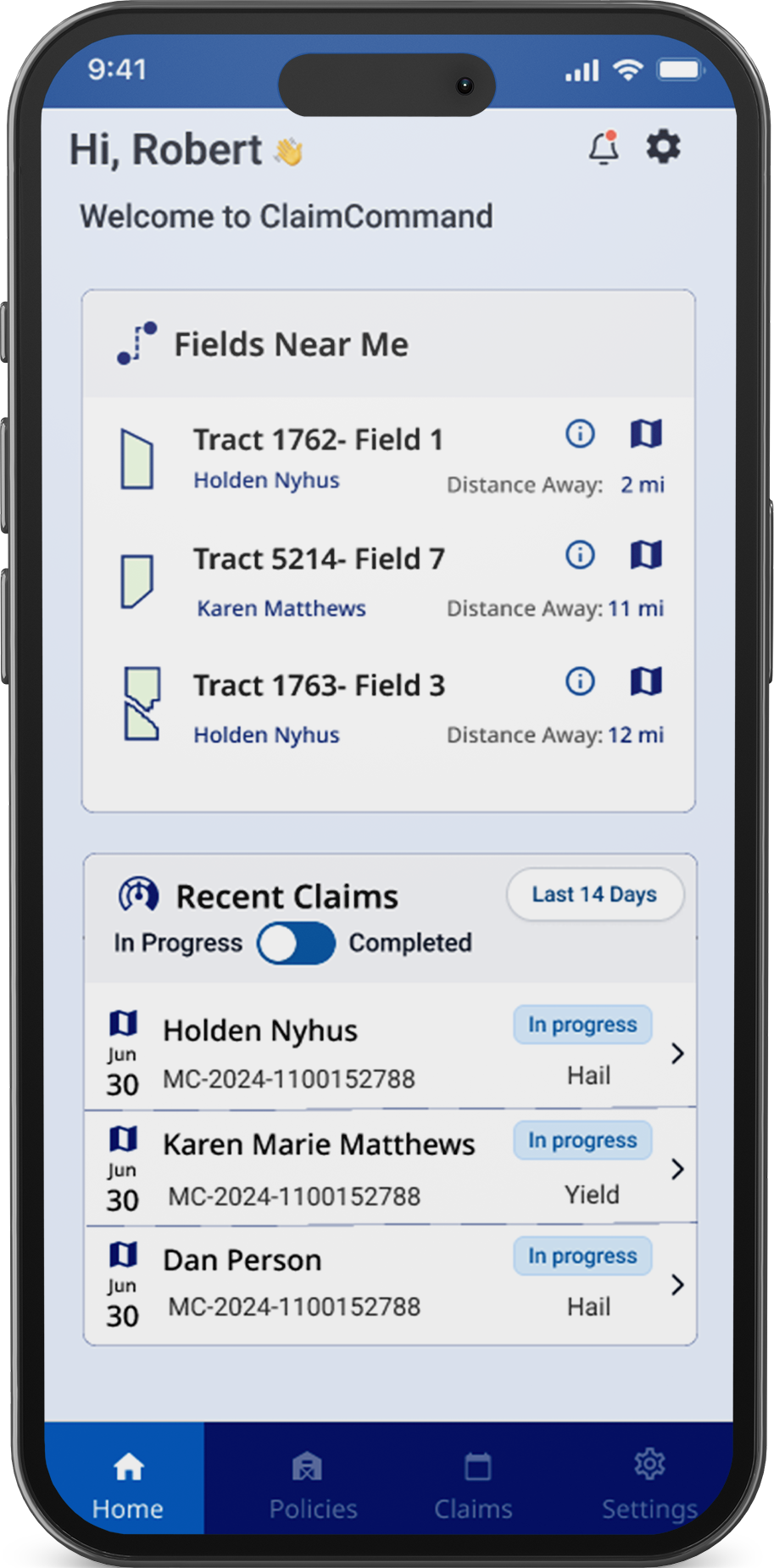

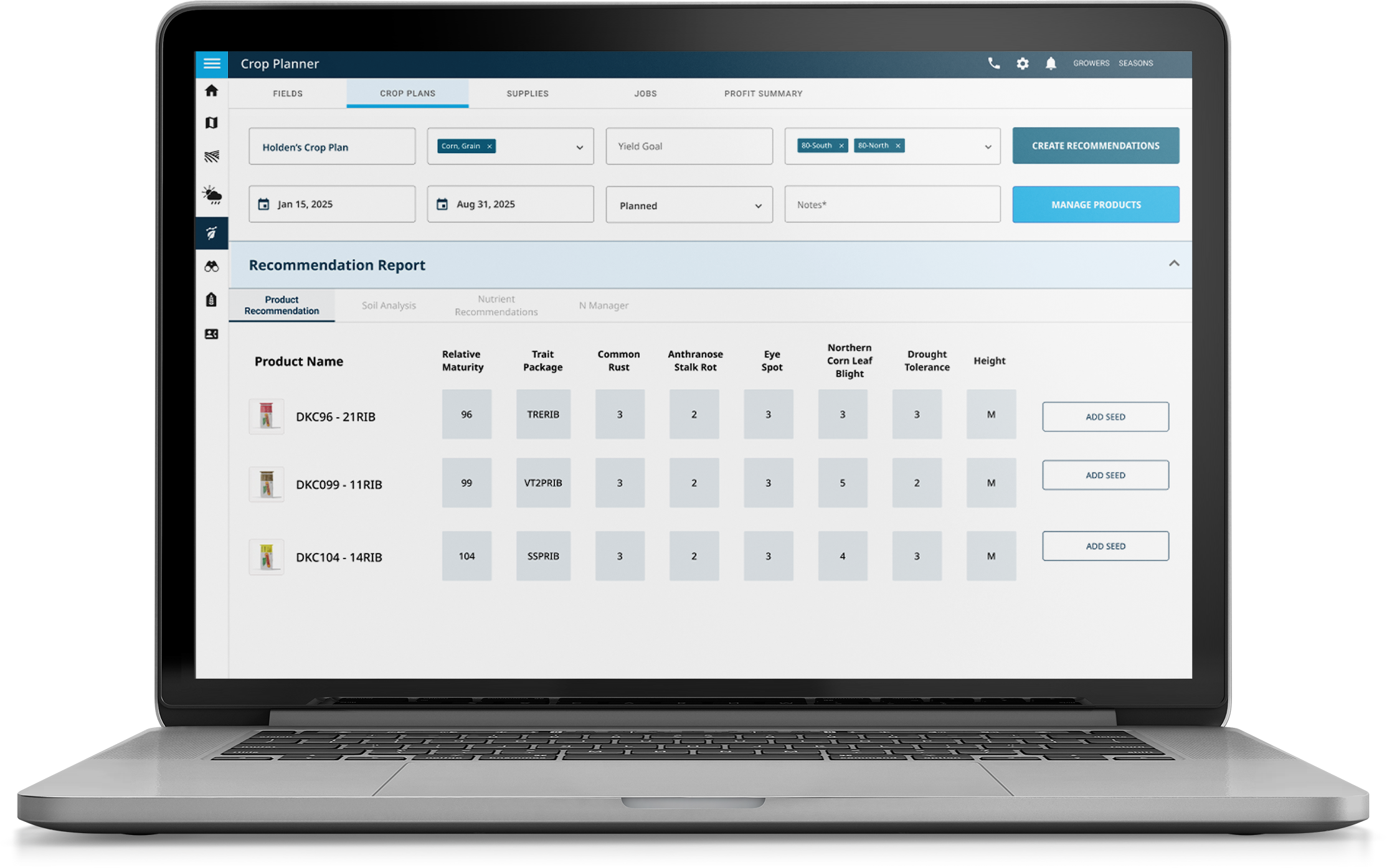

Mobile Adjusting: Your Adjuster’s Advantage

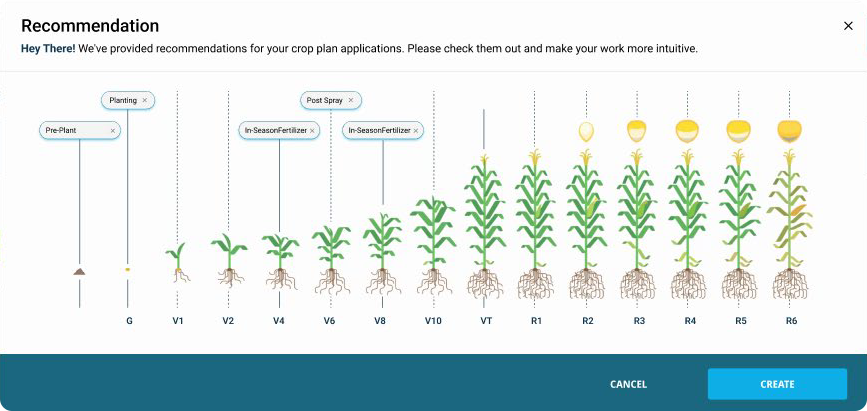

Speed up claims by up to 40% with a mobile app designed to digitize and empower your adjusters’ workflow. SmartClaim is a white-labeled, offline-capable mobile app built specifically for agricultural insurance claims.

Works offline in remote locations

Custom workflows & internal assessment forms

Remote-sensed crop damage, growth stage & weather overlays

Real-time sync between field activity and office systems

Fully managed onboarding and support

White-labeled to match your brand

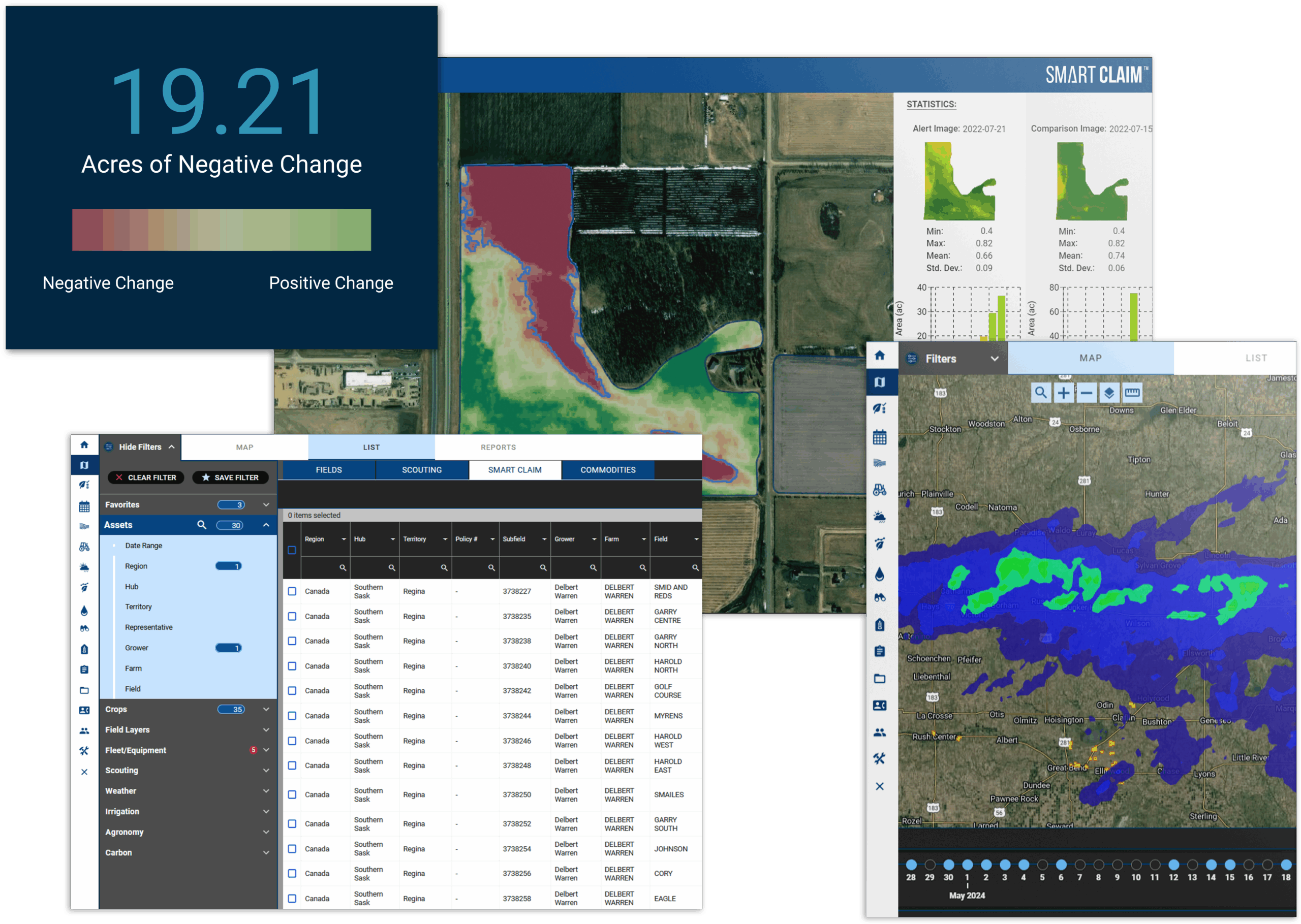

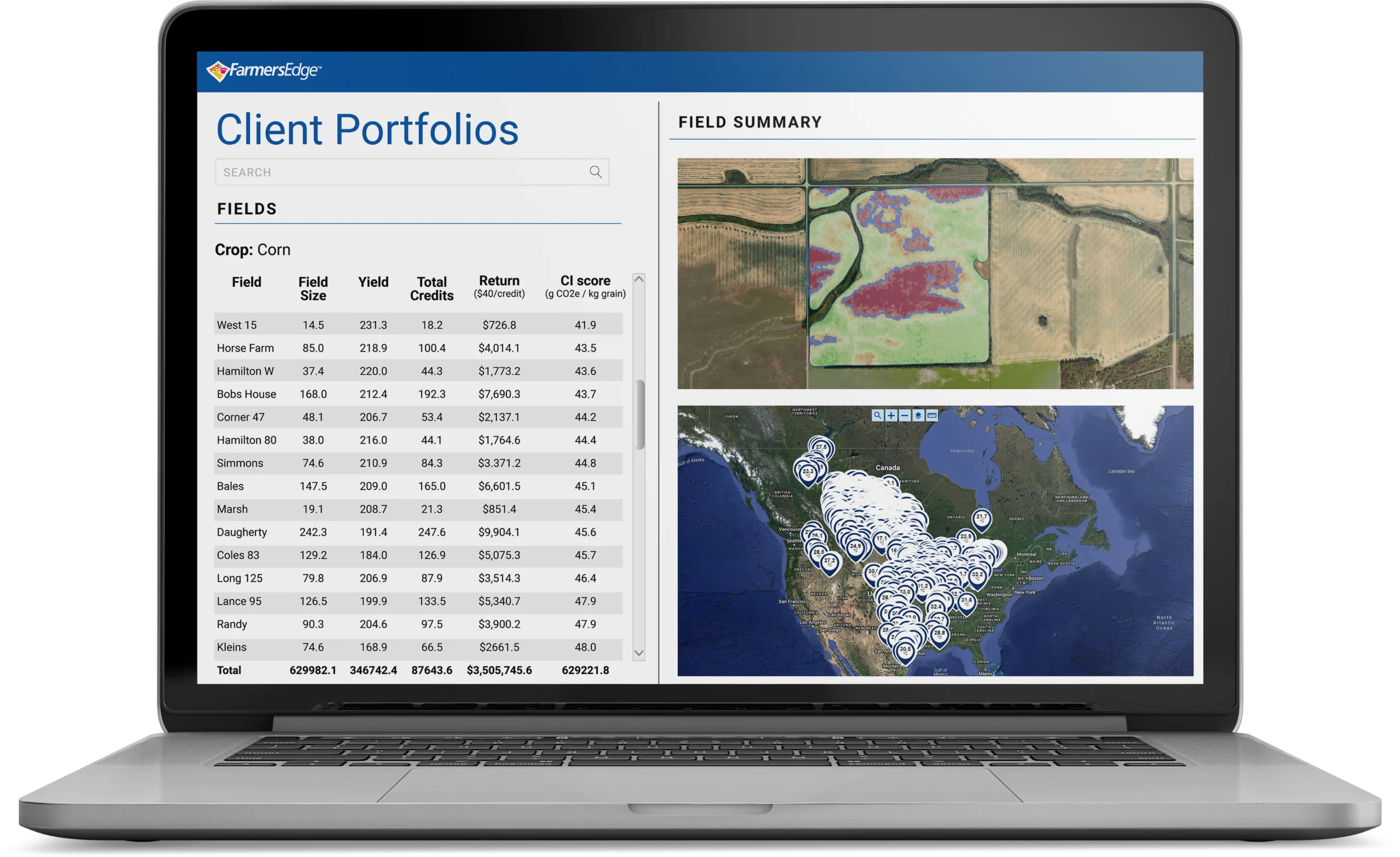

Forensic Claims:

Seamless Field-to-Portfolio Intelligence

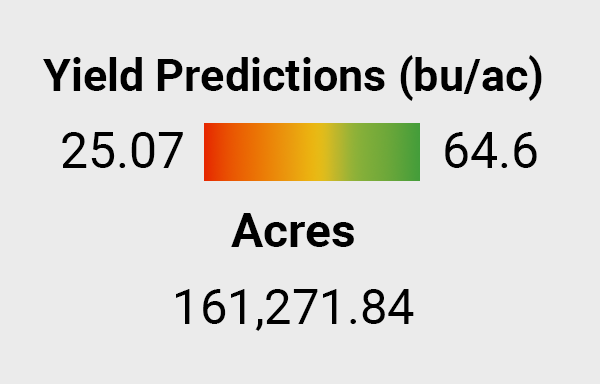

Tap into 95%+ accurate growth stage models and data from 7,000+ on-farm weather stations Our platform is built to provide visibility from individual claims to your entire book of business—customized for regulatory needs, operational scale, and faster decision-making

Validated Growth Stage & Pest Prediction Models: Utilize models tested across millions of acres for reliable crop assessments.

Remote-Sensed Damage Verification: Leverage high-resolution aerial imagery and satellite data for accurate, remote damage assessments.

Real-Time Crop Health Monitoring: Access live data feeds to monitor crop conditions and detect issues early.

Portfolio-Level Risk Indicators: Visualize risk distribution with intuitive, color-coded maps.

Audit-Ready Compliance Reporting: Generate comprehensive reports that meet regulatory standards with ease

Risk Assessment: Streamlined Reporting, Delivered Ahead of Seasonal Deadlines

With automated data feeds and pre-built reporting workflows, our platform gives insurers a measurable head start on key reporting requirements and risk assessments.

6–8 Week head start on Seeded Acreage Reporting

2–3 Month head start on Yield Production Claims

Field-level verification supported by high-frequency satellite and in-field data

Custom Solutions. Real Results.

From system integrations to data infrastructure and analytics, we work across partners and platforms to deliver technology that performs—no matter the challenge. Explore how our tools are being adapted, deployed, and scaled for real-world use.

Infosys Partnership

Discover how we’re collaborating with Infosys to bring scalable, enterprise-grade technology to the insurance industry.

SMHI

Case Study

See how we supported SMHI in delivering accurate, scalable crop insights across diverse regions.

SWITCH

Model

Explore our ground-breaking technology that creates detailed field-level maps of hail damage

White Paper: Crop InsurTech

Get in-depth insights on how digital tools are reshaping claims, underwriting, and compliance in ag insurance.

Build Your Digital Advantage

Whether integrating with your existing systems or developing something entirely new, we tailor every solution to meet your business and operational goals.