By Shane Thomas, Global Digital Ag Lead

Digital agriculture is revolutionizing the ag industry from the ground up; there are new tools to help optimize yields, manage time and produce better outcomes and profitability for farmers all over North America. Farmers Edge can help inform our farm customers and empower them to make profitable decisions in season and out.

The combination of data collection via hardware, an integrated platform and processing prowess, is continually providing utility to growers from an agronomic perspective. It is also evolving to enhance the management of day-to-day operations and help inform decisions that are strong agronomically, environmentally and operationally and from a risk perspective as well. This digital landscape is progressing its way to supporting other areas of farm business, specifically to one that lies near and dear to many: risk mitigation and insurance. The top priority for this is alleviating the challenges that occur throughout the insurance process.

As farmers, you are continually taking on risks to grow the most profitable crop; while data has helped to inform these decisions, there are still chances of heat causing yield loss, frost, hail and a variety of other events that can hinder profitability. Not to mention, when these events occur, it can be difficult to remain patient through the adjustment process, being kept informed throughout and waiting to receive the funds.

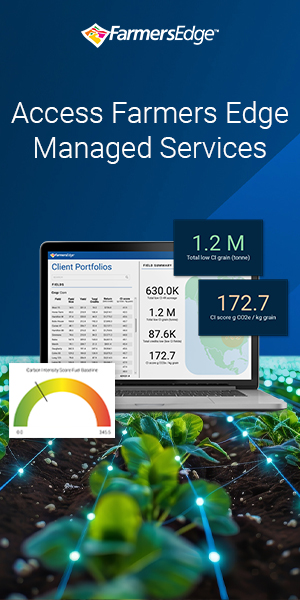

Farmers Edge is forging partnerships with cutting edge insurance providers in North America looking to offer a seamless and value-added solution to our mutual farm customers. There are numerous ways that this can be enabled, but today we will focus on weather-derived tools:

Extreme weather alerts

Through Farmers Edge suite of digital tools, we offer weather stations and forecasting that bring field-centric data to farmers on an hourly basis. These insights great agronomically but can be excellent from an insurance perspective too!

When a devastating storm goes through any given geography, if a farmer has Farmers Edge tools, insurance through our strategic partners and has allowed the insurance provider to access their data for purposes of supporting claims, the insurance provider will get an extreme weather alert. This shows farmers and adjustors when extreme weather occurs, eliminating the need for the farm customer to phone their insurance provider to alert them of the event. This, in turn, shows the adjustor where to go and prioritizes your farm and fields for assessment and adjustment! No more having to wait for weeks for the adjustor to arrive.

Change in crop health

Farmers Edge high-resolution satellite imagery and proprietary imagery analytics enables farmers to catch problems before they cause significant yield issues. This tool can also be beneficial to farmers for insurance purposes. With our Crop Health Change Map and Notification toolset, we can inform exactly what areas of fields were hit and to what degree – helping adjustors plan when there is an event that needs assessment the most impacted areas first inspect the worst impacted areas, and this also further informs adjustors.

Growers with Farmers Edge intelligence and a strategic insurance partner can streamline their adjustment time and cut down on time to payments coming back into the farm account, increasing cash flow.

Risk will always be inherent in farming, but we’re working to support farmers with our strategic partnerships to enable them to farm confidently, stress less and sleep soundly through any challenge that comes their way.